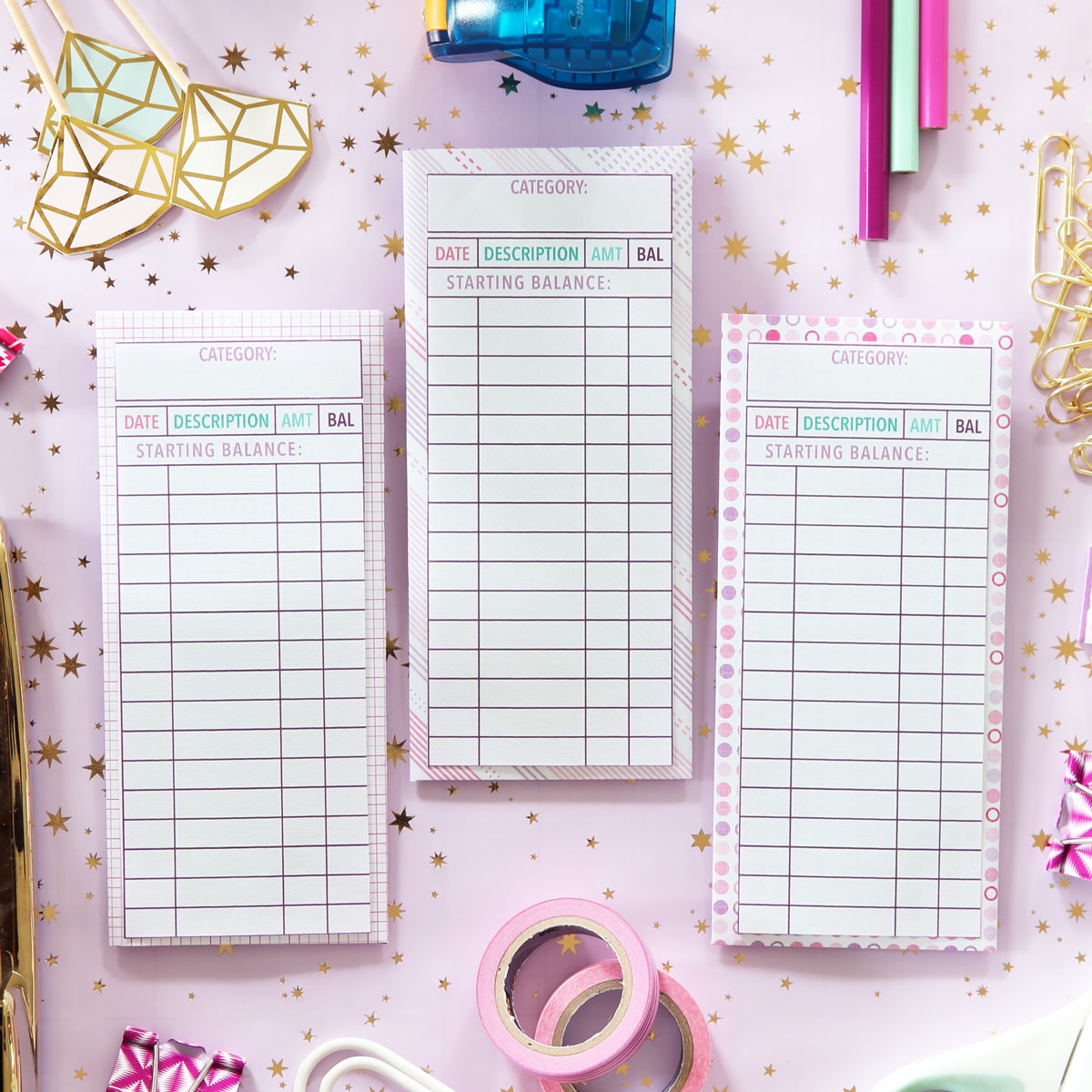

Free Printable Check Register

The free printable check register helps to track spending in each budget category so you can stay on track with all of your financial goals!

One of the trickiest parts of budgeting can be knowing how much we’re spending on variable expenses. These are things like groceries, gas, clothing, household supplies, and more.

So that we can be sure that we’re sticking to our budget and spending our money wisely, it’s important to track our spending. There are lots of different ways to do this. But sometimes it’s simplest to see it spelled out for us on paper in black and white (or pink and purple, if you prefer)! 😉

Our free printable check register pages are designed to help you track your variable spending by category so you always know where you stand with your budget.

Grab the Free Printable Checkbook Register

First things first– let’s print our tracking sheets! The free printable “checkbook register” comes in two cute color schemes so you can pick the one that best fits your personality, preference, or mood. (Or go crazy and use a combination of both!)

You will want to print out one sheet for each variable budget category you create and keep track of each category on a separate page. Some examples of these categories could be:

- Groceries

- Eating Out

- Household Items

- Gas

- Clothing

- Personal Care

- Gifts

- Entertainment

- Hobbies/Fun Money

We can be as general or as specific as we’d like. We just need to make sure we’re tracking! Snag the printables by clicking on the button below.

(If you prefer to use the cash envelopes method of budgeting to keep track of your variable spending, grab free printable cash envelopes here.)

How to Use the Check Register Printable

Once we’ve printed one tracking sheet for each variable spending category in our budget, it’s time to get them set up. At the top we can write the name of the category we’re tracking and the amount we’ve budgeted for that category.

If we’re not sure how much to budget for a particular category, we have a few options. An easy way to get a ballpark figure is to look back at the past few months of bank statements and tally up our expenses in that category. This will provide a general idea of how much we should plan to spend going forward.

If we don’t have access to our bank statements or don’t want to take the time to look back at them, we can simply track our spending for the first month without declaring a budget amount. That will give us a good starting point. And then we can set a specific budget amount to try to stick to for the following month.

(Learn more about creating a budget here.)

After we’ve filled in the category and budgeted amount, we will simply record the details of any purchases we make within that category. There’s space to note the date of the purchase, what is was, and how much we spent. Then there is also room to keep a running balance of how much we have left to spend of our budget in that category for the month. We could also make any notes we may have about a particular purchase.

How do I keep track of all of my purchases?

This post contains affiliate links. For more information, see our disclosures here.

Especially when there is more than one person making purchases in the household, it can be difficult to make sure we’re tracking every one. Here are a few ideas that could help ensure we’re not missing anything.

1. Have a designated “inbox” for receipts.

For purchases we’re making in person, we typically receive a paper receipt. We could create a designated inbox in our home where everyone could compile their receipts to be recorded. The inbox could be as simple as soft pencil pouch clipped into the front of our Budget Binder.

Grab this soft pencil pouch to help keep your receipts organized in your Budget Binder.

Then the person who is in charge of tracking spending can record all of the purchases from the receipts a few times per week.

2. Have online transactions sent via email.

Even if we are meticulously keeping track of paper receipts, we will inevitably have some online purchases for which a paper receipt does not exist. For these transactions, we can have receipts sent to a central email inbox so we can add them to the appropriate category.

3. Use online banking to reconcile your purchases.

This may be the simplest route of the three options. If we utilize online banking, we can simply log into our debit or credit card accounts. We’ll use the transaction history to make sure we’re recording every transaction in its designated category.

If there are multiple people in the household that are creating those transactions, it’s important to keep open lines of communication. That way we can always determine into which category each expenditure should fall.

There’s more where that came from!

The check register pages are part of our free printable Budget Binder! See all the printables in the Budget Binder and snag your copy in this post!

Free Check Register Printable: Final Thoughts

The thought of tracking all of our transactions each month may seem daunting. But with online banking and other digital options available to us, managing our spending and sticking to a budget has never been easier.

If you are a pen and paper person like we are, we hope this free printable check register will help you manage your budget successfully. You can do it!

Free Printable Check Register: Frequently Asked Questions

Want to save this post to revisit later? Be sure to pin the image below so you can find it easily!

Happy Organizing!

This post contains affiliate links. For more information, see our disclosures here.