Free Printable Budget Binder (with Cash Envelopes!)

This free printable budget binder can help you organize your finances, allowing you to spend less money and save more. Establish your financial goals, track your spending, make progress on paying down debt, save for the future, and more!

We all love the idea of paying down debt and saving more money, but actually making it happen can be a bit of a challenge!

Here at Free Organizing Printables, our goal is to try to make your life a little easier in whatever way we can, so we created a free printable Budget Binder that is packed full of sheets to help get our finances under control. (And dare we say, even make it a little bit fun in the process?!)

In this binder, you’ll find sheets to help you set financial goals, track your spending, boost your savings, pay down debt, and more.

Snag all the pretty printables below!

What is a Budget Binder?

A budget binder is a collection of printables– often housed in a three-ring binder– that helps people organize their finances. Whether you’re looking to set up a full budget and track your spending, gain some extra motivation to build savings or pay down debt, or just get a better idea of your full financial picture, a Budget Binder can be a great way to manage it all.

Since we know everyone’s brain works a bit differently, we made it a point to include several options for organizing various areas of finances so everyone can find printables that will be helpful for them.

Information in a Budget Binder is personal and sensitive in nature. Be sure to keep your Budget Binder in a safe place where your important info won’t be compromised.

Why Free Budget Printables Are Helpful

Budget Binder printables help provide accountability and can show us exactly where our money is going.

We tend to vastly underestimate what we’re spending. Keeping track of our purchases with a Budget Binder allows us to accurately account for how we’re utilizing our money so we can make effective changes to save more and spend less.

Our savings and debt payoff trackers are a fun way to visualize our journey as we work toward our financial goals and can provide additional motivation to do so.

And our account information sheets help us keep track of all of our info in one place.

Budget Binder Supplies

This post contains affiliate links. For more information, see our disclosures here.

Tools You’ll Need to Assemble an Organized Budget Binder

What should be in a printable budget planner?

Everyone’s Budget Binder will be different based on their own needs, goals, and personal preferences. You can use as many or as few of the printables as will be helpful for you.

The sections we’ve included in the Budget Binder are as follows (Click on the links below to be taken to that section.):

- Printable Binder Covers + Section Covers

- Financial Goal Setting Printables

- Spending Trackers

- Savings Trackers

- Debt Payoff Worksheets

- Account Information Printables

Free Printable Budget Templates

The easiest way to download all of the printables in the Budget Binder (in two cute color schemes!) in one place is to request your copy by clicking the button below.

Ready to take a look at everything that’s included in our free printable Budget Binder? Here we go!

Free Printable Binder Covers

Every binder needs a cute cover, and we just happen to have TWO cute covers for you! All of our printables come in two different color schemes– pink/purple and blue/green– so you can choose the one that best fits your project, mood, or personality. (Or mix it up and use pages from both!)

Throughout this post, we will be showing various printables in only one of the color schemes, but note that when you request your free printable Budget Binder, you will automatically receive each printable in both color schemes!

Setting Financial Goals

Nearly all of our binders start with a goal setting section, and for good reason! Goals are a great way to set an intention for what we want to accomplish. Then the rest of the pages in the binder are designed to help us work toward those goals.

For each section of the binder, we have a pretty printable cover page so you can keep all of your pages neat and tidy.

Set Long-Term Financial Goals

Our first printable in the goal setting section is pretty straightforward. It gives us space to declare our goal, give ourselves a deadline for achieving that goal, and then make a plan for how we’re going to get there.

This page has space for setting four different goals, but if you want to make more than that, you can print out multiple copies of this sheet.

Checking in on Your Goals’ Progress Each Month

Along with establishing our initial financial goals, it’s important to revisit them monthly to see how they’re coming along.

This monthly review sheet has room to note what went well during the previous month and what could be improved in the upcoming month.

It has space to break down your larger overall goals into smaller goals for this month. And it has room to make some extra notes for anything you want to remember.

Tracking Spending with a Budget Binder

One of the trickiest parts of budgeting can be keeping track of what we’re spending. The printables in this section aim to make that a lot easier!

With pages for establishing your budget, monitoring recurring expenses and variable expenses, and noting charitable contributions, you’ll know exactly where your money is headed at all times.

Of course, we have a cute cover for the “Tracking Spending” section of the binder…

Printable Budget Worksheet

This one-page printable budget worksheet is a great way to get an overview of our month at a glance.

There’s space to note income. We can keep track of recurring expenses and variable expense categories. There’s room to write down what we were able to save and how much debt we were able to pay down. Then we can create a summary at the bottom and see how our final numbers worked out.

For each section of the printable, there is space to note a budgeted amount, the actual amount, and the difference between the two. By the end of the month, you’ll have a very clear financial picture to look back on!

(Not sure how to make a budget? This post can help.)

Bill Tracker Printable

Sometimes it’s helpful to have a list of recurring bills that we pay each month, quarter, or year. These are things like:

- Mortgage/rent

- Car payments

- Student loans

- Insurance payments

- Utility bills

- Memberships

- Tuition or lesson fees

For each bill, there’s room to write down what the bill is, the amount due each month (If it varies a little, like with a utility bill, we usually list the average payment.), and the date the bill is due. Then there are boxes for each month to check off when the bill has been paid.

Printable Cash Envelopes

Along with keeping track of our recurring bills, we also need to keep track of our variable spending categories. These are things like:

- Groceries

- Clothing

- Eating out

- Entertainment

- Gas

- Gifts

- Car maintenance

- Household expenses

One method that people like to use for budgeting for variable expenses is to use the cash envelope system, made popular by Dave Ramsey.

Each envelope represents one budget category (groceries, for example). At the beginning of the month or pay period, we get out the amount of cash we have budgeted for that category and put it in the envelope.

Then we use only the cash in the envelope to pay for our purchases in that category so we always know how much we have left.

There are two parts to our cash envelopes printables. There is an envelope template, which we like to print on the back of a piece of scrapbook paper so it’s pretty. And then there is the tracking sheet, which prints three to a page.

With the envelope template, we print it, cut it out, and fold on the dotted lines. We can then secure it with tape or glue dots. After printing the tracking sheet, we can cut them out and use tape or glue dots to secure them to the front of each envelope.

At the top of each tracking sheet, there is space to write the category of the cash envelope. Then we write our budgeted amount in the “starting balance” space. From there, each time we make a purchase from that category, we use the chart to note the date, description of the purchase, the amount, and the remaining balance.

This will give us a running log of how much we’ve spent and how much we have left to spend in each category.

Free Printable Check Register

If you prefer not to use the cash envelope system or would rather track your expenses in a binder, we have printable pages for that too! This printable acts like a checkbook register to help us keep track of our purchases.

We print one tracking sheet for each variable spending category in our budget (groceries, clothing, eating out, entertainment, etc.). There’s room to write the category and our budgeted amount for that category at the top of the page.

Each time we make a purchase in that category, we can note the date, a description of the purchase, the amount we spent, and the remaining balance for that category. There is also space for any notes you may want to add.

At the end of the month, we can clearly see how much we’ve spent in each category. (And we can add it to the printable budget worksheet to get an overall picture of our finances for the month!)

Keeping Track of Charitable Contributions

If you make charitable contributions throughout the year, you’ll be glad you kept track of them when tax time rolls around! Use this page to note any time you make a tax deductible contribution.

There is room to note the date of the contribution, the recipient, the donation type (Cash? Clothing? Other goods?), the amount of the donation, and how it was paid. (Cash? Check? Card?)

Boosting Savings with a Budget Binder

Along with tracking our spending, a Budget Binder is also handy for helping us save more money! This section of the binder has several printable pages to help you do just that.

Of course, it starts with a pretty cover page…

Savings Bucket List

It’s good to keep track of everything we want to save for. A vacation? Christmas fund? New car? Downpayment on a house? Whatever you want to save for, you can keep track of it on this page.

There’s space to write down what you’re saving for, how much it costs, how much of a priority that item is (high, medium, low), and a deadline for reaching your savings goal.

Then we have several fun pages to help you track your savings!

Savings Tracker Chart

Our first savings tracker is a standard chart. List your savings goal at the top.

Then in the “Amount” column, write savings milestones by number, with the highest number at the top. There are 20 spaces, with each space representing 5% of our savings goal.

So for example, if we want to save $1000, we would write $1000 in the top space, $950 in the second space, $900 in the third space, and so on.

In the “Month” section, we’d start by writing the current month in the first space, next month in the second space, and so on.

Then each month, we fill in the squares of how much we’ve saved toward our goal and watch our chart go up as our savings goes up!

Savings Tracker Road Map

This savings tracker helps measure our progress by following a path to savings! There are 100 boxes, with each box representing 1% of our savings goal.

So for example, if our goal was to save $1,000, each box would represent $10 saved, so we can color in a box each time we add another $10 to our account.

$1,000 may seem like a daunting goal, but $10 is totally do-able! Being able to mark off a box each time we meet a small milestone can motivate us to keep pushing toward our ultimate savings goal.

Savings Tracker Piggy Bank

This cute piggy bank savings tracker can help us measure our savings as well! Again, there are 100 circles inside the piggy bank, with each one of them representing 1% of our savings goal. Fill up the piggy bank, and watch your savings account fill up at the same time!

Savings Tracker Jar

The savings tracker jar is the exact same concept as the piggy bank, just in a different shape. Again, there are 100 circles in the jar, with each of the circles representing 1% of our savings goal.

Jewel Savings Tracker

Or choose the jewel savings tracker to measure your savings progress! With 100 jewels in the bowl, we’ll color in one jewel each time we reach 1% of our savings goal.

Tackling Debt with a Budget Binder

Along with adding to our savings, we want to try to decrease our debt! We can keep track of all of our payments and visualize our debt repayment in some fun ways in this part of the Budget Binder.

It all starts with a cute cover page…

Debt Overview

The debt overview sheet is exactly what it sounds like. We can write down each debt we owe on this single page so we get a full view of all of the payments we need to make in one spot.

There’s space to write down the name of the debt, how much we owe, the interest rate, and our goal payoff date. And we can get the satisfaction of checking off the box at the end whenever our debt is completely paid off!

Debt Payoff Worksheet

Once we’ve made a list of everything we owe on the debt overview page, we can use the debt payoff worksheet to track our payments each month.

At the top of the page, there’s room to write the debt name, along with the starting balance. Then each month, we can track the minimum payment required, any additional payment we’ve made, and the remaining balance we have on the debt.

At the end of the year, it will be so rewarding to look back on this sheet and see how far our debts have decreased!

Debt Payoff Tracker Chart

On this chart, we can watch our debt amount decrease month after month! Start by writing the name of the debt and the starting balance at the top of the page.

Then in the “Amount” column, we’ll write the total amount we owe in the top box. There are 20 boxes, so each one will represent 5% of our debt.

For example, if we owe $10,000, we will write that in the top box. Then in the second box, we would write $9,500. The third box would say $9,000, etc.

In the “Month” section, the current month would go in the first box, next month in the second box, and so on.

For the current month, we will most likely color in the boxes all the way to the top, to our full debt amount. If we pay off $500 the second month, we’d color in all the boxes except the top one that month. As our debt decreases, we’ll fill in fewer and fewer boxes until it is completely paid off.

Debt Payoff Tracker Road Map

Similar to the savings road map, we’ll track our debt payoff 1% at a time, filling in one of the 100 circles each time we pay down 1% of our debt.

If we have a debt of $10,000, for example, we’d color in a circle each time we pay off $100 until we’ve paid off 100% of the debt.

Debt Payoff Tracker Thermometer

Track your debt repayment 5% at a time with this debt payoff tracker thermometer!

There’s space to write the debt name and starting balance at the top. Then each time we pay off 5% of our debt, we get to fill in the next chunk of the thermometer until it is completely full.

Debt Payoff Tracker Wheel

The debt payoff tracker wheel also measures our debt repayment 5% at a time. We can color in a wedge each time we pay off 5% of our debt or break it down even further and color in a partial wedge whenever we pay a smaller amount. The choice is yours!

Debt Payoff Tracker Banners

Finally, these debt payoff tracker banners allow us to measure our progress little by little. Each flag represents 1% of our debt, so we’ll finish off one full banner each time we make 10% progress on our debt repayment.

All 10 banners will be filled in when we pay our debt in full!

Managing Account Information with a Budget Binder

Finally, this last section of the budget binder helps us keep track of all of our important account information in one spot.

Like the rest of the sections in the Budget Binder, it starts with a pretty cover page…

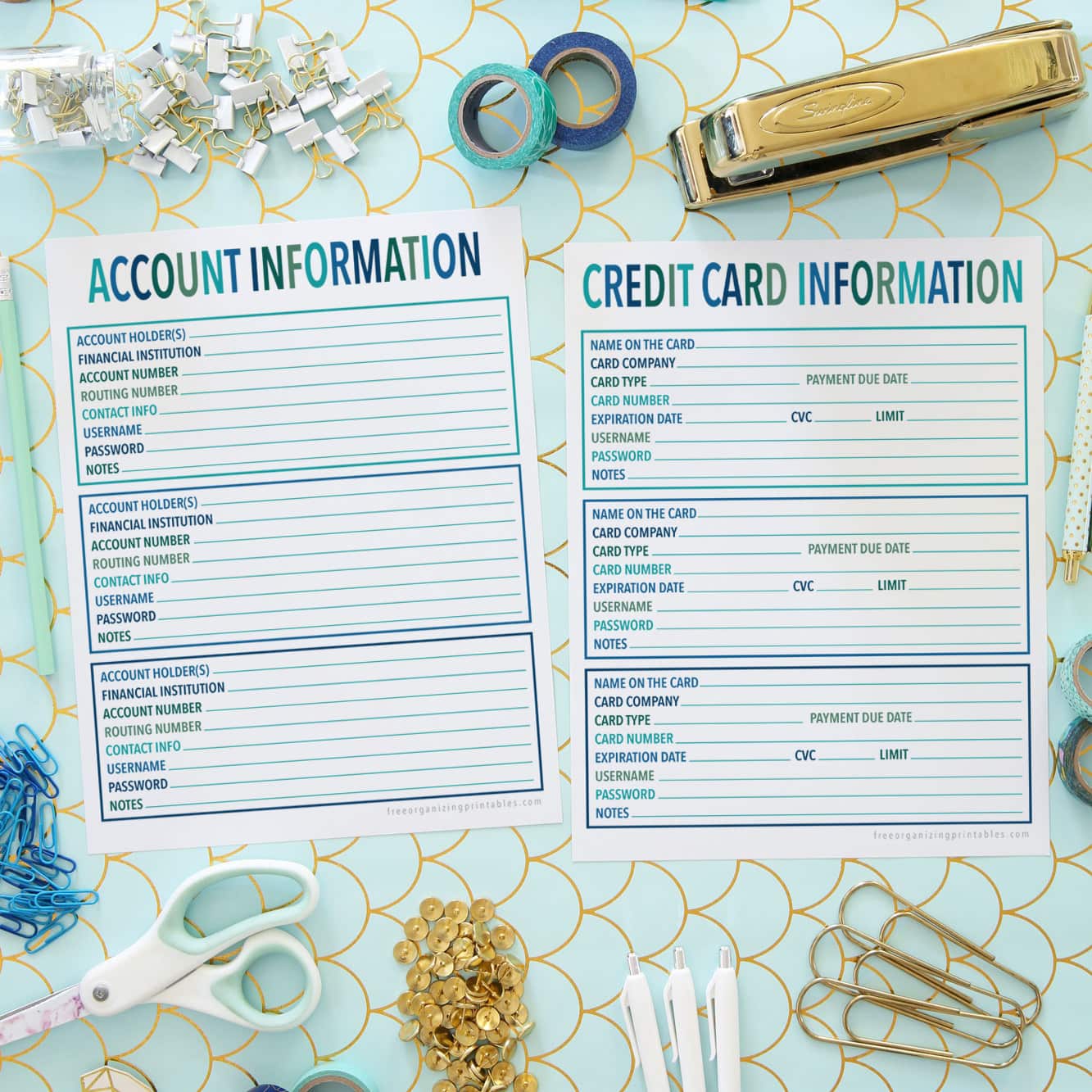

Account Information Printable

This account information printable can help us keep track of all of our important financial accounts in one place.

For each account, there is space to write the name(s) of the account holders, the financial institution, account number, routing number, contact information for someone at the financial institution, your username and password for the website, and any notes you want to be sure to remember.

To track more than three accounts, feel free to print off multiple copies of this sheet.

Credit Card Information Printable

Similarly, this credit card information printable can help us keep track of all of the credit cars we currently have open.

There’s space to write the name of the owner of the card, the card company and type, along with the day the payment is due each month. We can write the card number, expiration date, CVC, and card limit. Finally, there’s room to keep track of our website username and passwords and any notes we want to keep on hand.

Again, to store information for more than three cards, simply print out multiple copies of this page.

Budgeting Worksheets Printable Pages: Final Thoughts

Whew, that was a lot of information! We hope these Budget Binder printables will be helpful for you as you work to organize your financial life!

Whether you’re creating a budget or looking for a fun visual way to track your savings and debt payoff amounts, we will be thrilled if these printables can play even a small role in helping you reach your financial goals. We can’t wait to see you crush it!

Budget Binder Ideas: Frequently Asked Questions

Want to save this post to revisit later? Be sure to pin the image below so you can find it easily!

Happy Organizing!

More Printable Binders

Looking for even more pretty printables? Snag our other printable binders too!

This post contains affiliate links. For more information, see our disclosures here.