Free Printable Budget Worksheet

Grab this free printable budget worksheet to establish a simple, effective budget that will help you save more money (even if you’re a budgeting beginner)!

We all want to save more money, right?! But the process of figuring out how to set up a budget can feel a little daunting.

In this post, we wanted to take the complexity and confusion out of setting up a budget, AND provide you with a simple tool that will make the budgeting process a lot easier.

Let’s get to it!

Download the Budgeting Worksheets

First things first– download your free printable budgeting worksheet (in two cute color schemes!) by clicking on the button below. This sheet will help walk us through the budgeting process step by step.

How to Create a Simple Budget

After you’ve downloaded the printable, it’s time to come up with the perfect budget for you!

Step 1- Figure out your net income.

The first thing we want to track on our budgeting sheet is our net income. This is not our full salary– it’s the amount we make minus taxes and deductions.

In the income section of the budget worksheet, we’ll write down the net income we make from our main job, as well as any side hustles we may have. If you are budgeting for a two income household, you’ll record your spouse/partner’s income as well.

In the income section, as well as the other sections of this worksheet, there is a spot to write the budgeted amount as well as the actual amount.

So let’s say you have a side hustle that generally nets $500 per month. You could put that in the “Budget” box. But if you happen to have a great month and net $1000 from your side hustle instead, you would write that in the “Actual” column and note the difference of +$500.

Step 2- Record recurring expenses.

Recurring expenses are our bills, payments that are generally the same every month. Some of the items in the recurring expenses section may be:

- Mortgage/rent

- Car payment

- Student loans

- Utilities (gas, water, electric, sewer, etc.)

- Gym memberships

- Cable/streaming services

- Internet

- Cell phone bill

- Subscriptions

Anything that has the same general payment each month can go in the recurring category. To figure out how much to budget for each item, look at your past bank statements to get an idea of how much you’ll owe.

Step 3- Keep track of variable expenses.

Recurring expenses are pretty straightforward because they are mostly the same every month. Variable expenses can get a little trickier because they can fluctuate quite a bit.

Variable expenses are things like:

- Groceries

- Eating out

- Gas

- Clothing

- Entertainment

- Household items

- Gifts

- Personal care

- Hobbies/fun money

To get an idea of how much we should budget for each of these categories, again, we can look at past bank statements.

It may be helpful to keep a record of our variable expenses throughout the month to make sure we’re staying within our budgeted amount. You can grab our cash envelopes or variable expense tracking sheets in our free printable Budget Binder to help with that.

It’s important to be realistic when setting budgeting goals for our variable expenses categories. We will only feel defeated if we set our numbers so low that we can’t possibly reach them and find ourselves overspending each month.

Step 4- Set goals for saving and paying down debt on the free printable budget worksheets.

Along with paying our bills and managing our variable expenses, we’ll often want to put money each month toward paying down debt more aggressively or making progress toward big savings goals like a vacation fund, holiday fund, retirement, college savings, and more.

Our printable has room to track those things too! If those goals are built into our budget (and bonus– automated transfers from our bank account), we will be able to pay down our debt and build up our savings much faster.

Step 5- Review the entire month on the beginner printable budget worksheet.

The last section on the budget worksheet helps us create a summary for the month, showing what we’ve budgeted, what we actually spent, and the difference between those two numbers in each of our categories.

This will give us a very clear picture of our finances for the month, and it can also help us to…

Step 6- Tweak the budget for next month.

If we find that we are consistently over or under budget by a significant amount in certain categories, that may be an indication that we need to tweak our budgeting goals. It’s important to review the numbers each month and make changes accordingly.

There’s more where that came from!

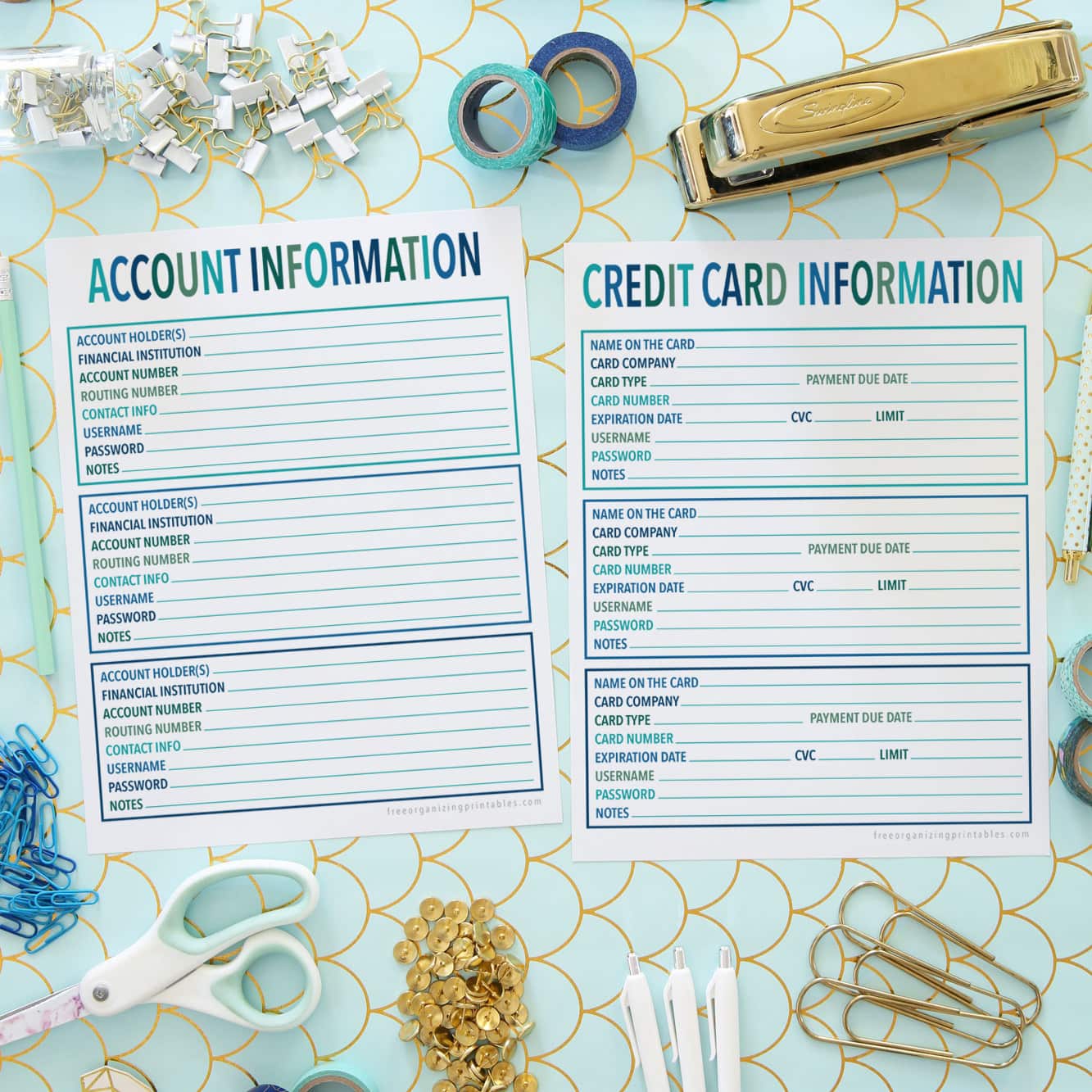

The budget worksheet is part of our free printable Budget Binder! See all the printables in the Budget Binder and snag your copy in this post!

Budget Worksheets Printable: Final Thoughts

Setting up a budget may seem tricky, but in reality, it’s actually pretty straightforward– especially when you have the right tools!

Our budget worksheet will walk you through the process step by step so you’ll be saving more and spending less in no time. You can do it!

Budget Worksheet PDF: Frequently Asked Questions

Want to save this post to revisit later? Be sure to pin the image below so you can find it easily!

Happy Organizing!