Free Printable Debt Payoff Planner

Grab these free printable debt payoff planner pages to help you track as you pay down your debt so you always know where you stand with your finances.

Many of us would like to pay down our debt. Debt adds to the amount of money we need to come up with each month. And it can feel debilitating if we have a lot of it. But in order to get rid of our debt successfully, we’ll need a plan to make it happen.

These debt payoff worksheets were designed to help us get organized. They’ll allow us to see the big picture of what our debt looks like. And they’ll also give us a methodical way to pay down our debt month by month.

Free Printable Debt Payoff Worksheet PDF

Ready to get organized so we can pay off those pesky debts? Our debt payoff worksheets are available in two oh-so-cute color schemes. You can snag them both by clicking on the button below!

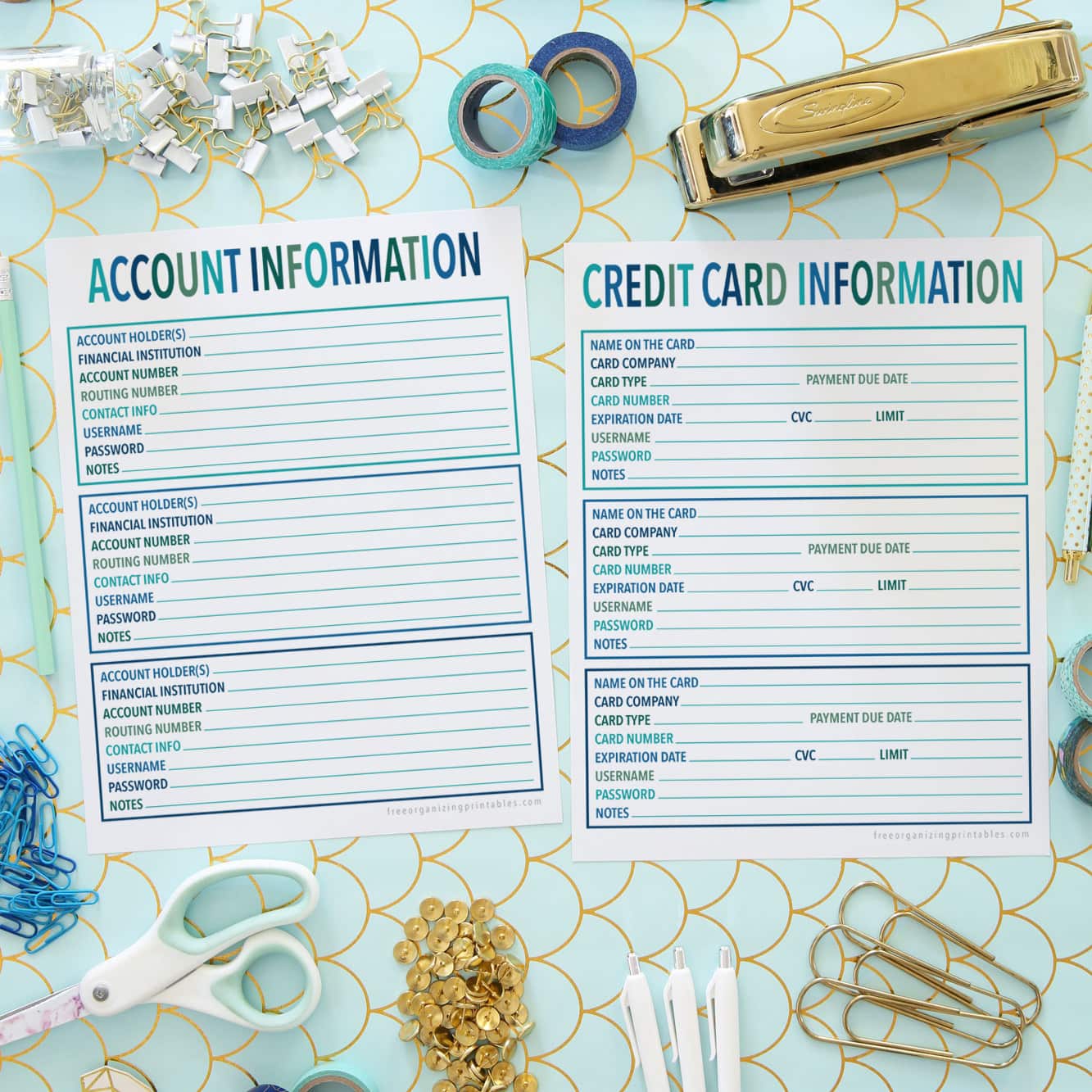

Related: Free Printable Account Information Sheets

How to Make a Debt Payoff Plan

Like many of our goals, paying down our debt will be a lot easier if we have a plan. Thankfully, it doesn’t have to be complicated!

Step 1- Fill out the debt overview worksheet.

Our first worksheet is designed to give us a bird’s eye view of all the debt for which we are currently responsible.

For each of our debts, we’ll list the debt’s name and the amount we currently owe. We’ll also note the interest rate of the debt and our goal payoff date. There’s even a spot to check off the debt when it’s been completely paid. Ahhhhh… so satisfying!

Once we’ve completed the debt overview worksheet and have a good idea of where we stand, we can decide on the strategy we want to use for paying off our debt.

Related: Watch your debt dwindle down to nothing with our free debt payoff trackers!

Step 2- Decide whether you’ll use the debt snowball method, the debt avalanche method, or a combination of the two.

Two common debt pay down strategies that can be helpful for people are the debt snowball method and the debt avalanche method. Let’s take a closer look at both of them.

What is the debt snowball strategy?

To use the debt snowball method, we would work to pay down the smallest of our debts first, just paying minimum payments on any larger debts. After the first, smallest debt is paid off, we take the money that we were paying toward that debt and put it toward our second smallest debt.

This continues on up the line– as we finish paying off a debt, we roll the money we were using to pay it into the payment for our next debt, working from the smallest debt to the largest one. The “snowball” of extra money that we’re paying towards our debts gets bigger and bigger as we make our way up to our largest debt.

The upside to the debt snowball strategy is that since we are starting with small debts, we often pay them off fairly quickly, which can give us motivation to keep going. The downside to this strategy is that we’re not necessarily paying off the debt with the highest interest rate first, which means that we may end up paying more money over time.

This is why some people prefer the debt avalanche strategy to the debt snowball strategy.

What is the debt avalanche strategy?

With the debt avalanche method, we work on paying down the debt with the highest interest rate first. This helps us get rid of the debt that is most expensive to hold, so we will often end up paying less money over time. While we’re putting our extra payment toward the debt with the highest interest rate, we’re making minimum payments on the rest of our debts.

After we’ve paid off the debt with the highest interest rate, we move on to the debt with the second highest interest rate. Like the debt snowball method, we take the money that we were putting toward the loan with the highest interest rate and now add that to our payment for the debt with the second highest interest rate.

As we tackle the debts with lower and lower interest rates, the amount of money that we are able to apply to the loan should get higher and higher.

Though we often end up paying less money over time with the debt avalanche strategy because we’re tackling the debt with the highest interest rate first, it can sometimes take a long time to pay off that first debt, which can be discouraging. There’s not always the same exciting “quick win” that we’d get with the debt snowball method.

Should I use the debt snowball method or the debt avalanche method?

Everyone’s circumstances will differ– the amount of debt we have, our interest rates, the number of loans we’re responsible for– so only you can decide which method will work best for your specific situation. You may even find that a combination of both methods works for you!

No matter which method you choose, the key is to stick to it and be consistent over time. It’s not always fun to pinch our pennies so we can pay off more of our debt, but the end result of being debt free is well worth the sacrifice!

Step 3- Use the debt payoff worksheet to track your progress on the method you’ve chosen.

Once you’ve decided on the snowball or avalanche strategy, it’s time to fill out the debt payoff worksheet.

If we’re using the debt snowball strategy, we’ll list our smallest debt in the far left box and then add the rest of our debts in increasing order from left to right.

If we’re using the debt avalanche method, we’ll put the debt with the highest interest rate in the far left box and then add the rest of our debts in order of decreasing interest rate from left to right.

As we’re writing the names of our debts, we’ll also note the starting balance. Then each month, we’ll note the minimum payment we made for each debt. For the debt we’re currently working on, we’ll write down the additional payment we’ve applied to that debt. And then we’ll write the remaining balance for each of our debts.

As the year goes on, it will be fun to see those balances decrease, with some of them even reaching $0!!

There’s more where that came from!

The debt payoff worksheets are part of our free printable Budget Binder! See all the printables in the Budget Binder and snag your copy in this post!

Debt Payoff Planner: Final Thoughts

Paying down debt is not always fun or easy. It takes hard work and sacrifice– often over a long period of time– to make it happen. But the freedom that comes with minimizing our debts is the most amazing reward!

It allows us to save more money, stress less, and be more intentional with how we use our funds because we’re no longer having to answer to our creditors. Paying off our debts may not be the easiest road, but it it definitely worth it in the end! You’ve got this!

Debt Payoff Worksheets: Frequently Asked Questions

Want to save this post to revisit later? Be sure to pin the image below so you can find it easily!

Happy Organizing!